After a series of Sisyphean tasks, I was able to purchase health insurance through the Washington State Health Care Exchange.

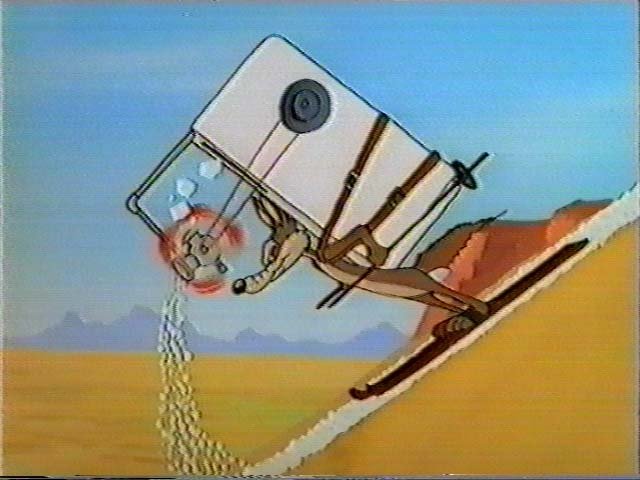

The obstacles were numerous; I began to feel like the whole system was built by the Road Runner and I was Wile E. Coyote, forever trying to catch the elusive bird. The “you can keep your plan” plan was shut down by the Washington state insurance commissioner. The site crashed and when it wasn’t crashed, it crawled. I was missing critical pieces of information about how to complete the application so I appeared ineligible for a subsidy. I was locked out by a password reset. Anything that went wrong required I call the exchange, and then, nine out of ten calls were met with an automated message saying, “We’re experiencing higher than average call volumes and can’t take your call right now. Please try again at another time.”

It was a textbook example of the word “clusterfuck.”

With some advice from the Washington Health Foundation, I was finally able to navigate the maze and come out the other side with a slightly better plan that costs slightly more than my previous plan. It’s not ideal and there’s some financial risk involved in that my rates are based on estimated income. If my income sucks for 2014, I’ll get some money back, if I do well, I may be slapped with a hefty fee when I pay my taxes at the end of the year. Income averaging would be nice for people in my situation — I had a $20,000 dollar differential between 2012 and 2013 — but further challenging the Jenga-like system of rules that govern the Exchange seems unwise at this point. I understand that.

On the whole, I support the concept of the Exchange. It’s deeply flawed in implementation, but I am hopeful (perhaps naively so) that it will settle in to a minor bureaucratic annoyance as opposed to the Catch 22-esque construction it’s been up until now.

But success on the Exchange did not end my woes.

At exactly the same time that I was navigating the Washington Exchange, I got broadsided by the need for expensive dental work. I don’t have dental coverage and it’s not offered through the exchange. I am in the process of paying off $3000 worth of dental bills for a root canal and a crown. Just for grins, I looked at dental plans. The annual maximum payout is $1000 and the plan is $50 monthly. It does not pay the expenses in full — only 30% of the work I had done would be covered. At one year of insurance, I’d have saved $310 dollars, at a second year, I’m in bad investment territory. The math doesn’t make sense. But don’t spend too much time on that, it’s not my point.

My point is that humans come standard equipped with teeth yet dental is not part of the Affordable Care Act.

I spent a good part of November and December extremely stressed out by health care. By the process of purchasing it, by my anxiety around having dental work done, and by the unwelcome and unavoidable hit of a used Toyota’s worth of expenses. As I write this, there’s a bill for $1300 dollars on my desk and I’m still in pain that should have been resolved by the $1700 dollar root canal performed at the end of November. I’m not too proud to admit that when my dentist told me I had to go back to the endodontist for more surgery, I spiraled into a pit of despair populated with doubts about self-employment (which I love and am good at), living in the US (which I chose over Austria because I am happier here), whether I should be taking an upcoming trip (I love to travel), and how this is a less than ideal birthday gift. Plus, it hurts.

I’ve complained about my woes to anyone that would listen, online and off, and yes, I did write my government representatives. Well meaning types suggested I go to Mexico, Romania, or Thailand to have my dental work done, to which I say, “Hey, if I could afford to jet off to Thailand, I wouldn’t be stressing out about my dentist bills, now would I?” Other well meaning types have suggested I get a job, with a traditional employer and benefits, until this situation has played itself out. An interesting idea, but one that underscores the nature of the problem. I lack of access to a health care system that doesn’t have me popping antacids because my gut is so churned from the resulting stress. Also, while I don’t have an employer, I actually do have a job. Advising me to give up the work I love so I can have insurance… well, pursuit of happiness, yo. (Hey, just read my friend Doug on this issue.)

I haven’t lost all perspective, rest assured. At the end of the year I signed a new client, picked up some great feature writing gigs for real pay, and took on some projects from a long term client. Our household income, as transitory as it feels, will absorb the hit, though it is a painful one. But I know people who would buckle under a $3000 bill for dental care. I know people who can’t absorb $420 a month for insurance. I know people who can’t “just get a job”, some of them laid off from 15 plus years in their careers. I know people who couldn’t jet off to foreign lands for dental care because it means lost income. I feel desperately sorry for myself, a victim of unfortunate circumstances, a situation exacerbated by the fact that I really, really, really hate going to the dentist. But I’m not so wrapped in self-pity that I don’t also feel deeply empathetic with others who have it much worse than I do.

Let’s talk cold hard cash for a minute. We paid $4800 for a high deductible insurance plan in 2013, plus an additional $1000 in out of pocket in medical expenses. I had no major medical issues — I had some standard blood tests, I had one filling replaced, and I got the flu. My dental work cost $3000 dollars. In 2014, we will pay $7200 dollars for insurance for two mostly healthy adults, plus, whatever the remaining expenses are to have my teeth repaired. The implications? I will not be able to pay my quarterly taxes or contribute to retirement funds for 2013. Instead, that money will go for dental bills.

When I do my taxes in April it will be interesting to see how this plays out. But $7200 a year — assuming there are no uncovered expenses — begs the question as to what is affordable health care and what that health care covers. $8800 — what we spent in 2013 — is not “affordable” at my income level. 2013 has deeply personalized why I need the Affordable Health Care act to work — and why I need it to cover all of me. I hope that 2014 personalizes how it is a change for the better.

§

Do you have a story about freelance life that you’d like to share? I made a flip remark on social media about how I was going to start “The Honest Freelancer, Tales from the Self-Employed,” and all kinds of people said, “I’d read that!” Or, “I’d write something up.” If you were serious, get in touch. I’d happily run your freelance truth telling tale right here.

I’m sorry you’re going through all this. You’re absolutely right about it being crazy that dental is not included, especially with the stigma associated with bad teeth and this supposedly being able evening the playing field.

Ouch, in every sense. I am really sorry you’re going through this and while I’m not entirely surprised dental is not included (and I’m guessing neither is optical) it still sucks pretty hard. I dream of the day health care is enshrined in the constitution with life, liberty etc.